is there a tax on death

While there are no direct taxes on death family members must understand certain tax rules to avoid a significant tax bill. Ontario Answer 189.

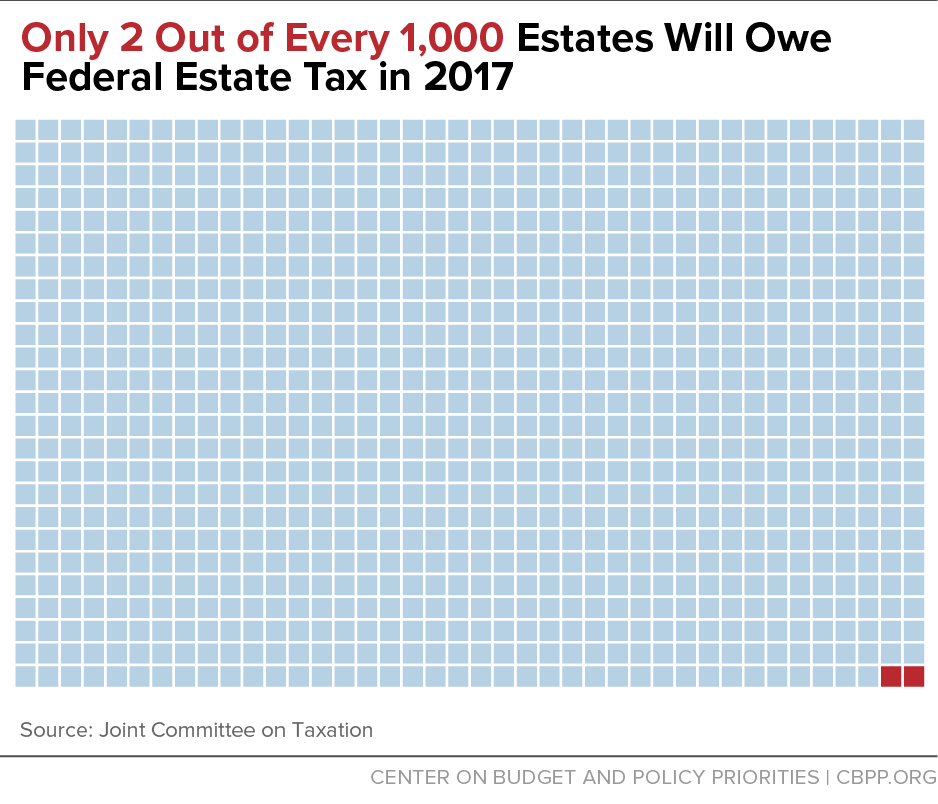

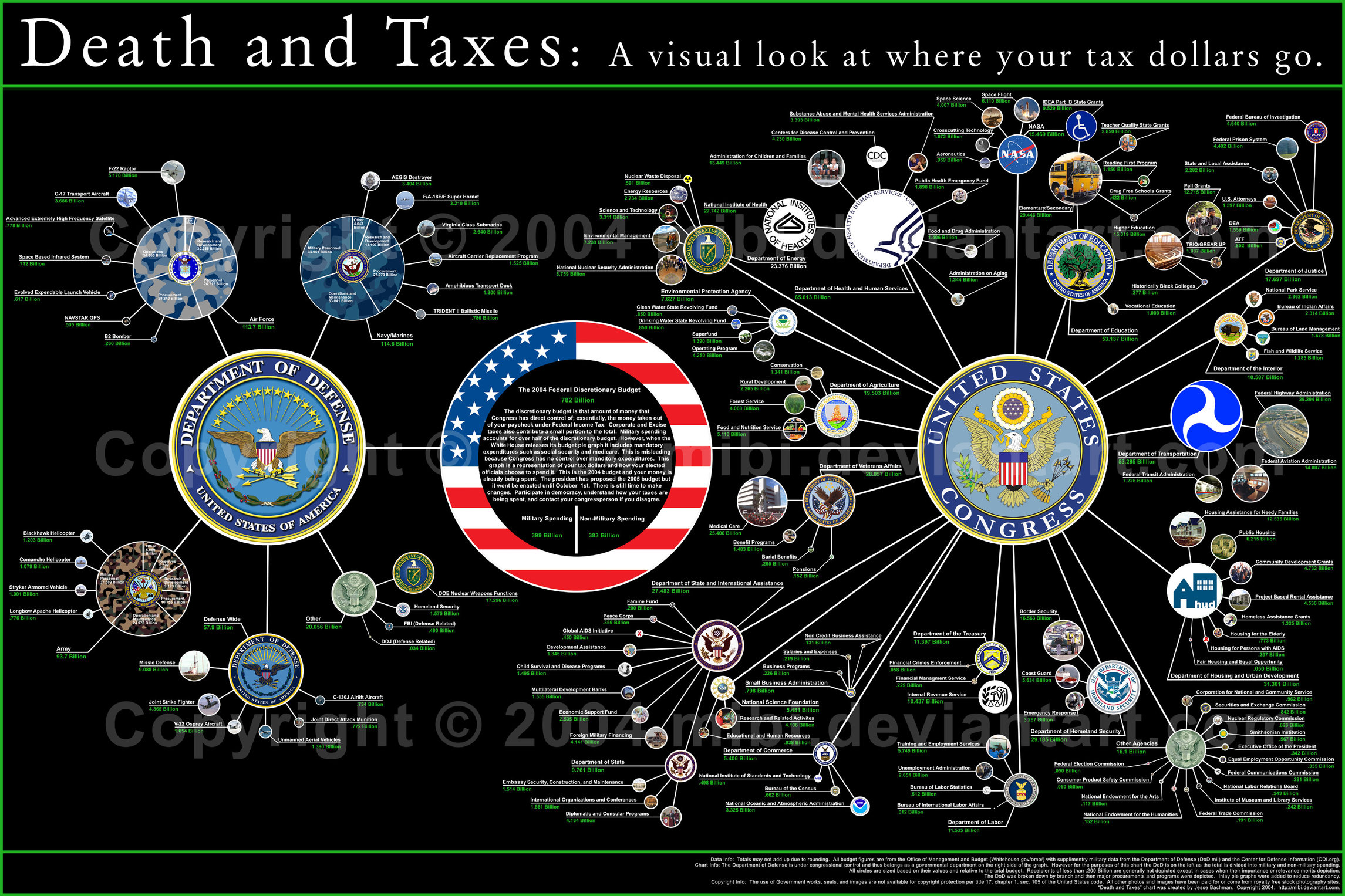

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

The Internal Revenue Service IRS imposes an estate tax on the value of all of an estates assets at the time of death.

. An inheritance tax by contrast is a tax on the privilege of receiving property from a deceased benefactor. It consists of an accounting of everything you own or have certain interests in at. Every taxpayer has a lifetime estate tax exemption.

The living heir pays an inheritance tax not the estate of the deceased. The Estate Tax is a tax on your right to transfer property at your death. The death tax can be any tax thats imposed on the transfer of property after someones death whether that tax is based on the total value of the decedents estate or the.

When a person dies and their. That amount increases to 1206 million for the 2022. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

All the assets of a deceased person that are worth 1170 million or more as of 2021 are subject to federal estate taxes. Score one for the politicians. There is a Federal estate tax that applies to estates worth more than 117 million.

In the US there are actually two different kinds of death taxes. It is an adjustment to tax basis and it can have a profound effect on the taxation of the assets. Estate and Gift Taxes.

Although there is no death tax in Canada there are two main types of tax that are collected after someone dies. This means that there would be effectively two or even three death taxes. A death tax is actually another name for an estate tax.

The estate tax which is levied by the federal government and certain states and the inheritance tax which is. And depending on where you live there may be state. But after death ownership tends to be dispersed and in many cases unresolved.

No not every state imposes a death tax. At death there is a little-known tax benefit that the federal government provides. If the policys current cash value exceeds the gift tax exclusion of 15000 in 2021 and 16000 in 2022 gift taxes will be assessed and due at the time of the original.

There are two types of estate taxes that can be imposed after death. You cant complain about taxes if. Each state has its own tax rates and criteria.

Its a federal or state tax on a persons estate after they die. The estate tax is a tax on your right to transfer property at your death. There is a federal tax where the IRS taxes portions of your estate.

For instance the inheritance tax rate is as much as 18 in Nebraska so a beneficiary might owe the government 18000 if they. So estates are a relatively easy target for the tax collectors. Only 12 states plus the District of Columbia impose an estate.

But is there a valid public policy. In addition the Green Book conspicuously ignores the estate tax. Federal capital gains possible state.

First there are taxes on income or on capital.

Retirement Money 105 Death And Taxes Retirement Money

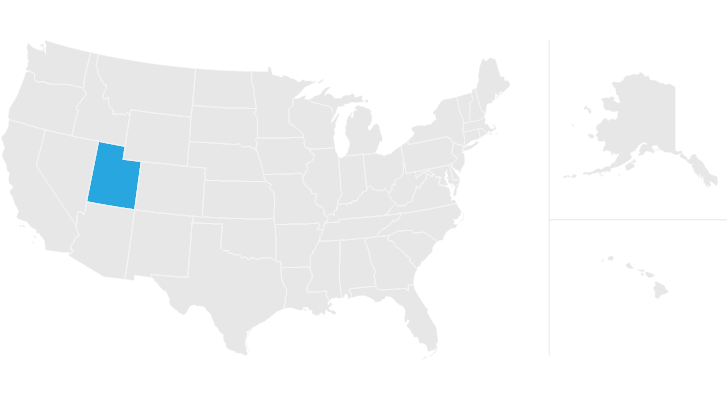

Utah Estate Tax Everything You Need To Know Smartasset

Death And Taxes Quotes Quotesgram

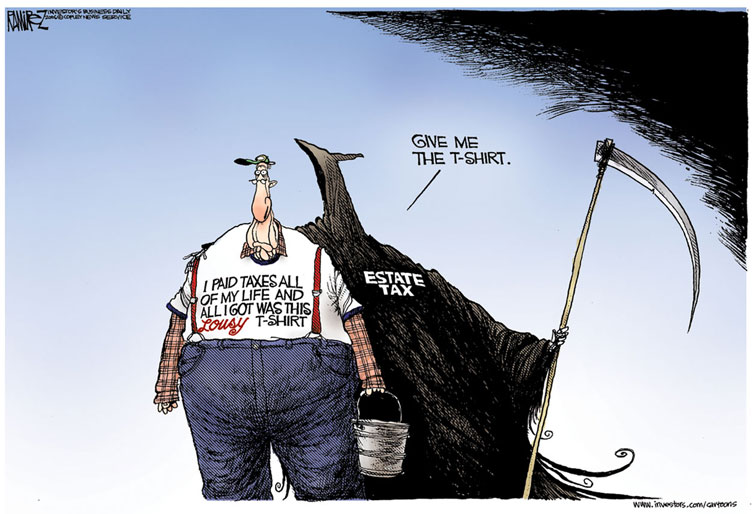

Setting The Stage Time To Deep Six The Death Tax American Encore

The Tax Advantages Of Life Insurance Bank On Yourself

Death Tax Definition Qualification Example How To Reduce

The Box Is There For A Reason Of Death And Taxes And Cockroaches The Box Is There For A Reason

Death And Taxes The Indian Express

Does A Death Tax Apply To A Deceased Estate Dore Webb Lawyers

What Is The Death Tax And How Does It Work Smartasset

What Is The Death Tax And How Does It Work Smartasset

Death Tax Also Known As Inheritance Tax Bishop Collins

No There Are Not Death Taxes In The Infrastructure Proposals Wusa9 Com

The Uncertainty Of Taxes On Death Tax Adviser

Is An Inheritance Tax Back On The Agenda Yourlifechoices