us exit tax calculation

The 9 parts are. The increase in the value of their principal residence located outside the United States 2.

Renounce U S Here S How Irs Computes Exit Tax

How is Exit Tax Calculated.

. In other words the law pretends the individual has sold all of his assets and tax will be owed on the pretend gain if any. Next is to determine if an exception applies. It will be as though you had sold all of your assets and the gain generated was viewed as taxable income.

Net capital gain after an exemption from the deemed sale is taxed immediately. The US exit tax applies to several different types of assets that may be owned by an expatriate and is calculated differently for each type. When a person expatriates they may become subject to an Exit Tax.

Generally if you have a net worth in excess of 2 million the exit tax will apply to you. Tax return as a dual status taxpayer in the year of expatriation Preparation of Initial and Annual Expatriation Statement Form 8854 Verification that you are fully compliant with US tax law for the prior 5 years. The CPA was asked to calculate the Exit Tax based on the following scenario.

The excess will be taxed as capital gains. This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax Your average net income tax liability from the past five years is over a set amount 171000 for 2020 You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Note that the amount refers to net income any deductions that reduce your tax burden reduces the net income figure Tax compliance.

Tax residents who have become US. Citizenship or in the case of a long-term resident of the United States the date on which the individual ceases to be a lawful permanent resident of the United States Sec. Each year is on the rise.

This determines the gain on your assets as well as the taxable amount of this above the threshold. The average annual net income that you are taxed on for the five years before you expatriate is more than a set amount. Who then renounce US.

The HEART Act also added the inheritance tax a 40 flat tax on the gross value of a covered gift or covered bequest made to a US. Non - U S. For purposes of calculating the exit tax the built - in gain or loss of each asset is computed by subtracting the assets adjusted basis from the assets FMV id.

Specified tax-deferred accounts including - IRA Roth IRA HSA 529 Plan Coverdell Education Savings Account Medical Savings Accounts. Essentially the first step is to determine if you qualify as US. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you expatriate is US1200 per ounce then you have no unrealized gain and wont owe any Exit Tax. Persons seeking to expatriate from the US. With the deemed disposition of capital assets your exit tax is calculated as though you have sold your worldwide property for fair market value FMV the day before you expatriate.

The exit tax calculation. Long-Term Resident for Expatriation. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

Note that the persons assets do exceed the 2000000 dollar US. Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return. In order to calculate the amount of exit tax that you owe you need to file the form 8854 which is an expatriation statement that is attached to your final dual status return and works out the amount of money that you would earn on your assets combined as well as the amount of this that can be taxed.

The Exit Tax The exit tax applies both to covered expatriates who relinquish citizenship and to green card holders who relinquish their green cards including those who abandon their green cards or take a treaty position if they held their green card for a period of 8 years during the last 15 years. Tax residents should note a special rule. If you are covered then you will trigger the green card exit tax when you renounce your status.

Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation 162000 for 2017 165000 for 2018 168000 for 2019 and 171000 for 2020. The exit tax rules impose an income tax on someone who has made his or her exit from the US. This is a substantial amount and can be devastating if not handled correctly.

Understanding Exit Taxes in a system of residence based taxation vs. Download or Email IRS 8854 More Fillable Forms Register and Subscribe Now. These simplified single-issue examples are only for clarity.

Citizen or Legal Permanent Resident. The defining feature is that assets are treated as if they are sold on the day before citizenship or resident status is terminated. This is Part 4 of a 9 part series on the Exit Tax.

Exit tax is based on whether the. Your average annual net income tax liability for the 5 tax years ending before the date of expatriation is more than the amount listed next. The expatriation date is the date an individual relinquishes US.

Exit Tax calculations and return preparation Preparation of the US. The amount is adjusted by inflation 2018s figure is 165000. In some cases you can be taxed up to 30 of your total net worth.

Exit Tax for Green Card Holders. Youre going to get taxed by the IRS on that US1 million gain. Exit Taxes in a system of citizenship place of birth taxation.

Thus the individual must pay US income tax on gain that he is deemed to have earned by operation of the exit tax rules when in fact the individual has not sold anything and is without any cash in hand to pay the tax. The exit tax is a tax on the built-in appreciation in the expatriates property such as a. With the ever-increasing IRS enforcement of offshore accounts compliance and foreign income reporting the number of US.

This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home. Currently net capital gains can be taxed as high as 238 including the net. Citizenship will have to pay the United States a tax based on.

Part 1 April 1 2015 Facts are stubborn things The results of the Exit Tax Part 2 April 2 2015 How could this possibly happen. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. If you have unrealized gains of more than 725000 US 2019 you will need to include these gains on your tax return.

The exit tax is generally payable immediately ie April 15 following the close of the tax year in which expatriation occurs. The percentage of exit tax is different for everyone as it is based on your marginal tax rates.

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax In The Us Everything You Need To Know If You Re Moving

Trading Plan Trading Charts How To Plan Swing Trading

Exit Tax Us After Renouncing Citizenship Americans Overseas

Green Card Exit Tax Abandonment After 8 Years

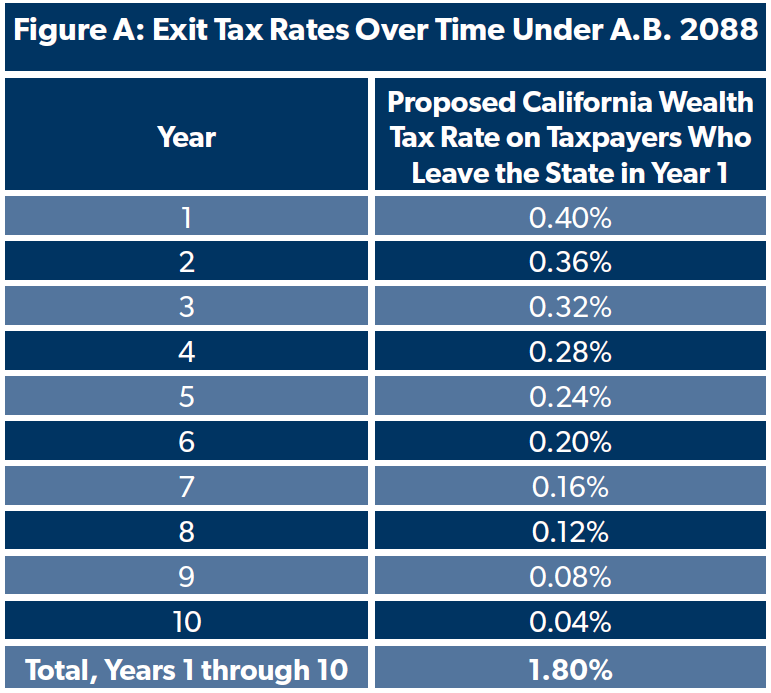

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

What Are The Us Exit Tax Requirements New 2022

Green Card Holder Exit Tax 8 Year Abandonment Rule New

The Tax Consequences Of Renouncing Us Citizenship

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

What Are The Us Exit Tax Requirements New 2022

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Exit Tax In The Us Everything You Need To Know If You Re Moving

Renouncing Us Citizenship Expat Tax Professionals

Entry Level Finance Jobs With No Experience Finance Jobs Finance Finance Blog

Exit Tax Us After Renouncing Citizenship Americans Overseas